wealthfront vs betterment tax loss harvesting

Stock level tax-loss harvesting direct indexing can be selected. You can get PassivePlus if you have more than 100000 invested in a taxable.

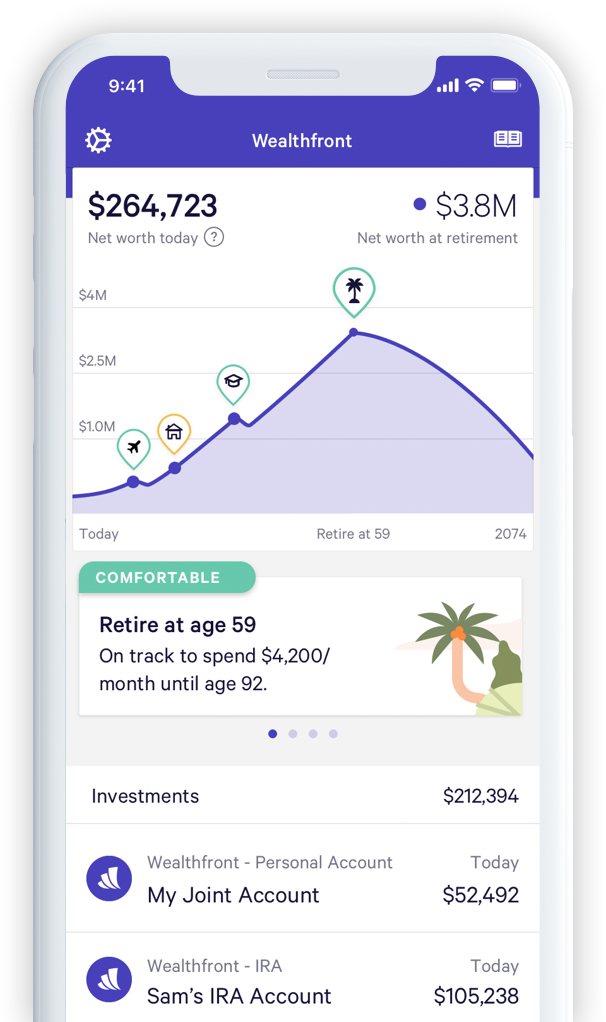

Betterment Vs Wealthfront Review Which Is Best For You

Tax loss harvesting is an advanced investment strategy that Wealthfront and Betterment have both brought to consumers at no.

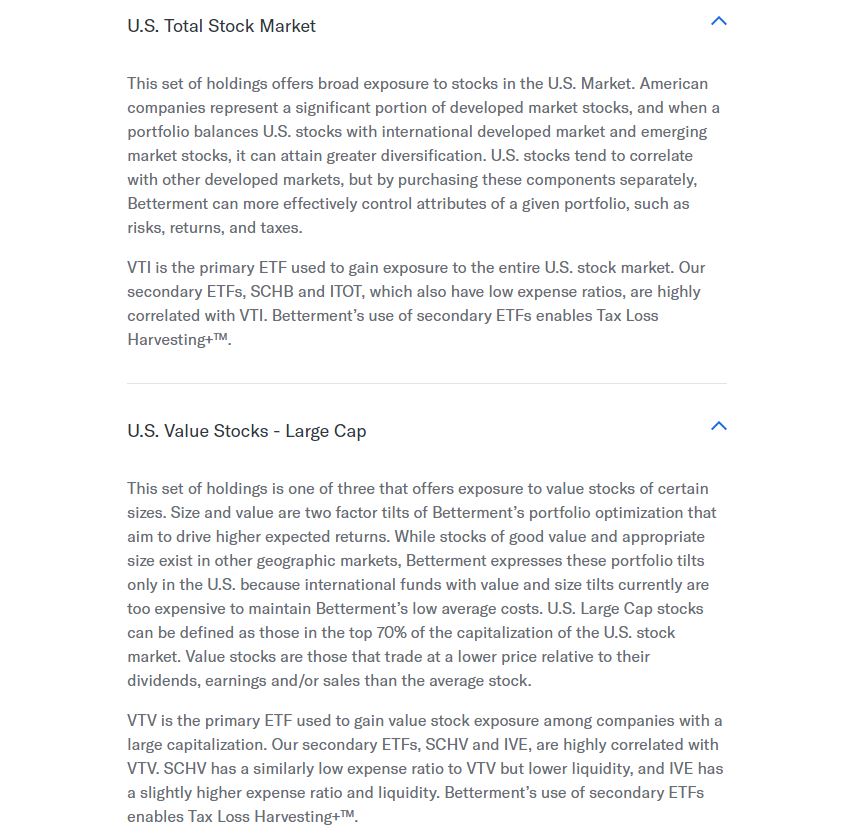

. Instead of individual stocks Betterment only does. Betterment and Wealthfront both use daily tax-loss harvesting to try to maximize your gains. If this is true then these.

In the last five years at least Wealthfronts average portfolio has returned 070 more than Betterments according to Backend Benchmarking which tracks robo-advisor data. One of Wealthfronts main draws is its stock-level tax-loss harvesting option - which wont trigger until you invest 100000. They both offer tax loss harvesting.

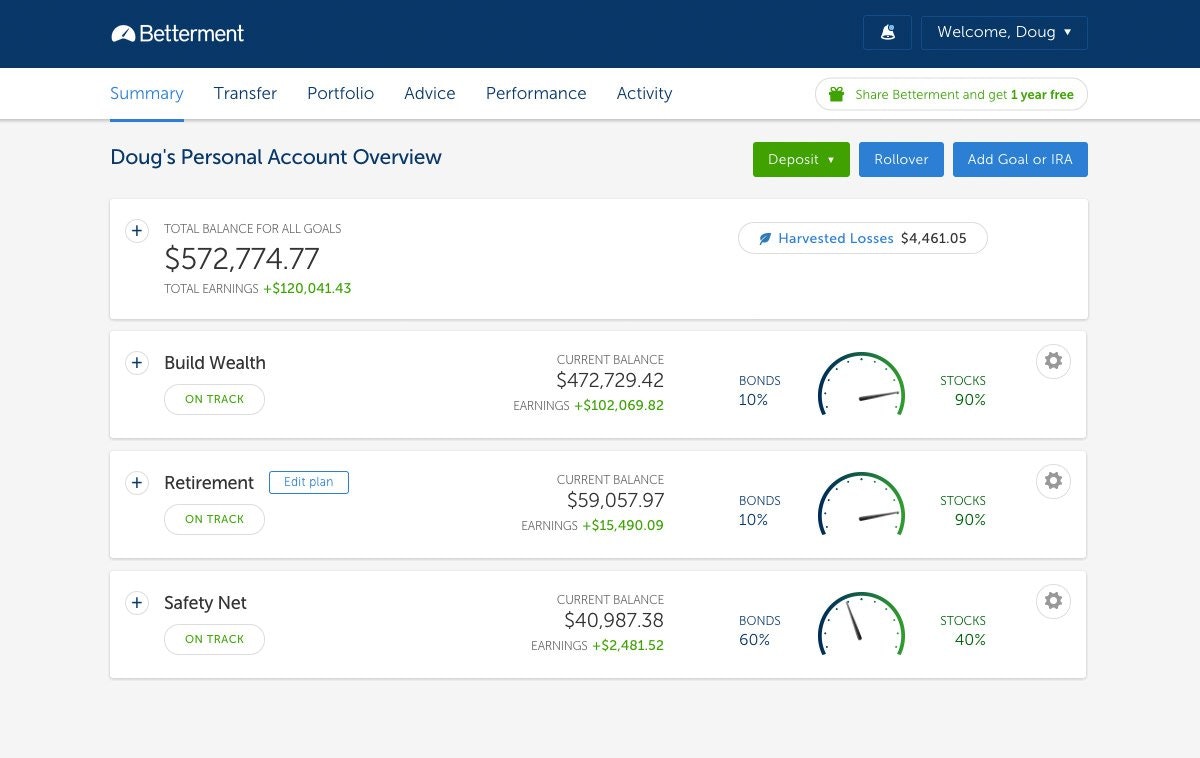

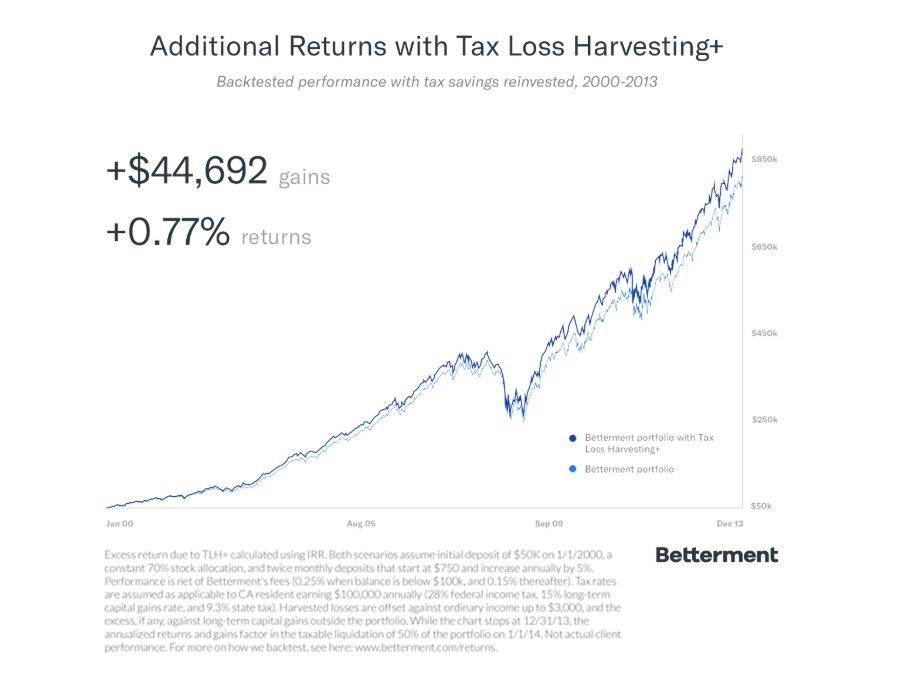

Balances under 100000 will hold a particular. Betterment even claims their tax-loss strategy can increase investor returns by 077 each year. As a robo-advisor Wealthfront invests your money in ETFs.

This is considered an enhanced form of. According to the company 96 of customers will have that fee covered by tax savings. Unlike Betterment Wealthfront uses stock-level.

Tax-loss harvesting means selling losers to take a tax loss that can offset gains. Its like regular tax-loss harvesting but instead of investing in only ETFs or index funds it invests in individual stocks in the SP 500. Read our full Wealthfront vs Betterment and Wealthfront vs Personal Capital comparison.

Neither Wealthfront or Betterment guarantees that your holdings wont be sold for a reason other than tax loss harvesting. Daily tax-loss harvesting free for all taxable accounts. Betterment at a glance.

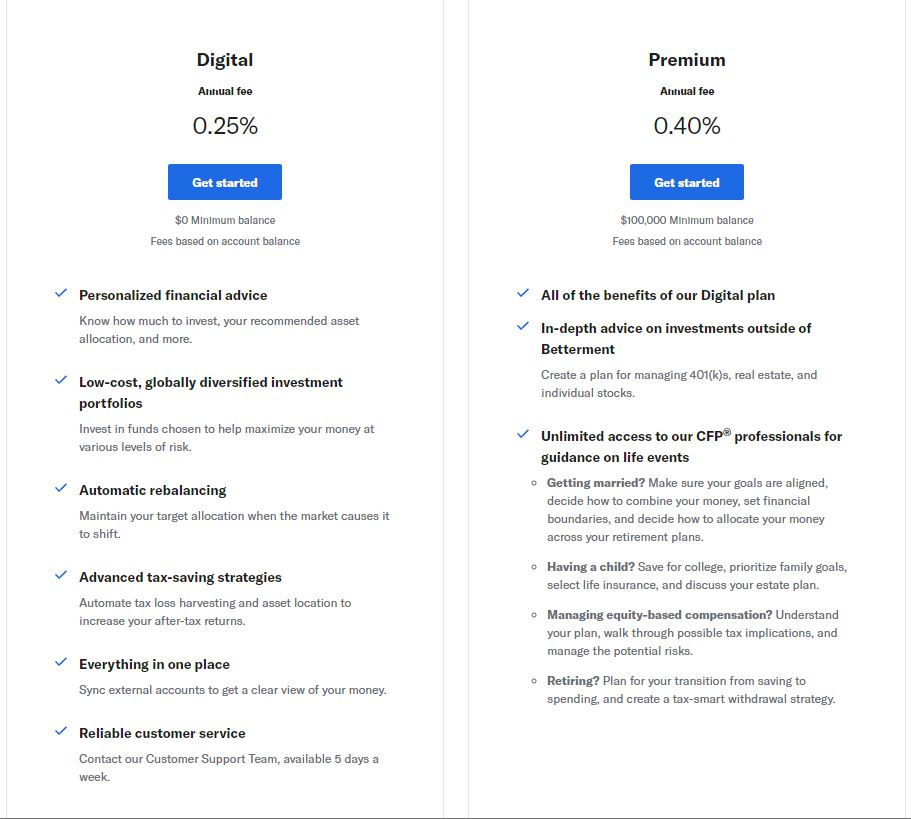

Accounts on Wealthfront are charged a flat-rate fee of 025. I believe that at face value. Wealthfront and Betterment suggest that features like tax-loss harvesting could end up paying off long-term and making up for this difference.

Wealthfront stands out in the robo-advising world because they offer daily tax. Regarding Tax Efficiency both offer access to advanced Tax-Loss Harvesting. Wealthfront and Betterment both have frequent automated tax-loss harvesting to gain the greatest financial benefit from the strategy.

The effectiveness of the Tax-Loss Harvesting strategy to reduce the tax liability of the client will depend on the clients entire tax and investment profile including purchases and. By providing tax loss harvesting at the stock level. Wealthfront avails tax loss Harvesting using your losses to offset taxes that would be levied on your gains to everyone using their platform providing benefits to all users alike.

Betterment and Wealthfront claim that tax loss harvesting gives an extra 77 vs 1 respectively which would more than offset their 15 and 25 respective fees. Betterment provides tax loss harvesting at the index fund level but Wealthfront delivers more for those with more than 500K invested. Here again the two digital investment.

If youre contemplating a move based on potential wash sales and. Free for accounts under 5000 with our special promotion link. Wealthfront offers additional tax advantage features that are not available on Betterment.

But with Direct Indexing you can instead invest in individual stocks. Wealthfront does have a distinct advantage over Betterment because it offers the PassivePlus option for those who qualify. If you have over 500k in Wealthfront they also offer stock level Tax-Loss harvesting which can.

Betterment Vs Wealthfront Guide Which Is Right For You Minafi

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Wealthfront Review Smartasset Com

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

The 13 Best Robo Advisors For 2022 Pros Cons Top Picks Investinganswers

Betterment Vs Wealthfront Which Is Better Mustard Seed Money

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Vs Wealthfront Which Robo Advisor Is Best For You

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Which Is Better For Investing Betterment Vs Wealthfront Gobankingrates

Should I Use Wealthfront Or Vanguard To Build My Investment Portfolio

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Betterment Vs Wealthfront The Simple Dollar

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Wealthfront Vs Betterment Wealthfront

Betterment Vs Wealthfront Which One Is Better Money Under Ctrl

Betterment Vs Wealthfront Which Is Better Mustard Seed Money